Writing a will: how it works and what you need to bear in mind

That's what it's all about

It doesn't take much to make your own will. Basically, a pen and a piece of paper are enough. But why should you write a will at all? What do you need to know beforehand and how do you draw it up step by step? Find out in this article.

Article overview

You need a will if you want to deviate from the statutory order of succession for the distribution of your estate

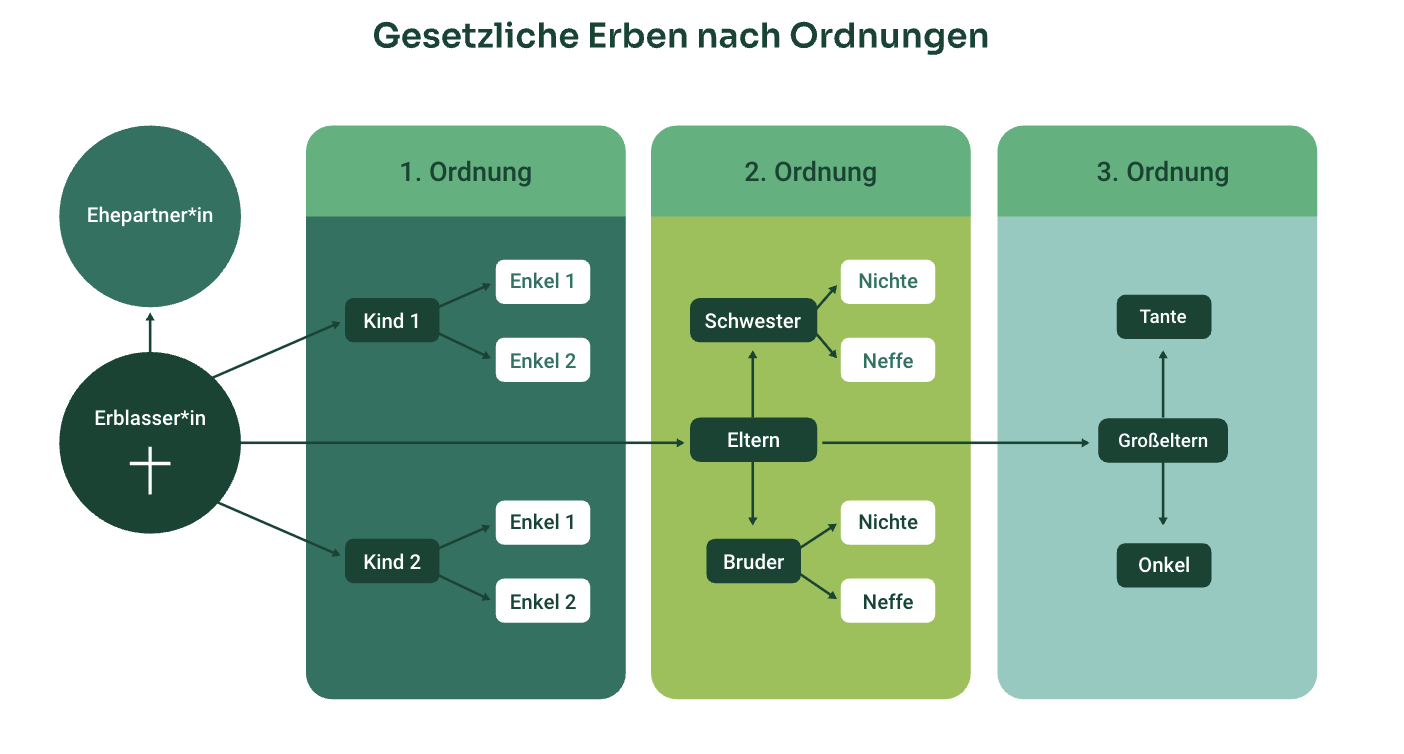

According to the legal order of succession, only the closest blood relatives inherit

Your will is only valid if it is handwritten or notarized

You can change, revoke or tear up your will at any time

Your testamentary donation to a charitable organization is exempt from inheritance tax

Before you start writing, you should, for example, appoint a trusted person, draw up an overview of your assets and write down your wishes

You can write a legally valid will by hand in 7 simple steps

1. When do I need a will?

Only with a will can you shape your estate in a self-determined way. Because a will allows you to do so,

- deviate from the legal order of succession,

- to provide specific persons with specific assets,

- to leave something to a charitable organization,

- special regulations and wishes can be implemented,

- prevent family conflicts and ambiguities,

- to handle the estate in a legally secure manner and

- sometimes to take advantage of tax benefits.

For example, if you want to leave a good friend the Ming vase she always loved, or if you want your neighbor to take care of your short-haired dachshund after your death, you need to write a will.

Without a will, intestate succession always applies in Germany. In this case, the only beneficiaries are blood relatives, spouses and/or registered partners or the state.

In the case of intestate succession, only blood relatives are entitled to inherit.

What happens without a will

Only your will partially overrides the legal order of succession. Making a will is much less about the orderly distribution of inheritance and much more about ensuring freedom of design and self-determination.

Also applies with a will: the statutory compulsory portion

Only the closest family members are entitled to the statutory compulsory portion. These include your own children and your spouse or registered partner. If there are no (or no longer any) children, grandchildren or parents may also be entitled to the compulsory portion.

The statutory compulsory portion ensures that close relatives are entitled to a minimum financial share of the estate. The compulsory portion claim is a purely monetary claim. The amount is half of the statutory inheritance share.

2. Prepare a will: You should clarify this

It's easy to write a will. It's even easier if everything has been thought of and important information is known. Below we show you what you need to know to prepare your will.

The difference between your inheritance and your legacy

With your will, you can both bequeath and bequeath your estate. However, there are important differences.

- When you make an inheritance, you specify in your will who will be your heir and therefore your legal successor. As legal successors, heirs assume all your rights and obligations - your assets and possessions such as your house, car, rental income, works of art, but also your liabilities. In case of doubt, heirs are therefore liable for debts from the estate with their own assets.

- With a legacy, the beneficiary person or organization (also known as the legatee) acquires a claim against the heirs. A legacy can be a sum of money, a property or an object. The heirs are obliged to fulfill the bequest.

Seek a conversation before leaving an inheritance

If you would like to appoint someone outside your immediate family or an organization as your heir, you should talk to them beforehand.

It is advisable to get to know the organization and check exactly how donations are used and managed, especially if the organization is an heir.

Transparency at Wilderness International

The handwritten or notarized will

You have two options for writing your will: by hand or through a notary.

A handwritten or personal will is the simplest form of testament. All you need is a piece of paper and a pen.

Important: A handwritten will is only legally valid if the entire text is handwritten and signed.

If you want to be on the safe side, eliminate misunderstandings and avoid formal errors, you can have your will drawn up by a notary or specialist lawyer. A notarized will guarantees legal certainty and is advisable for complex inheritance arrangements.

Non-profit status exempt from inheritance tax

If you leave your estate to a charitable organization, the inheritance or part of the inheritance is exempt from inheritance tax. For example, if you leave part of your inheritance to Wilderness International, we can save endangered rainforest without any tax deductions.

Important: The organization must be certified as a non-profit organization by the tax office. Non-profit status is subject to important conditions.

Checklist: Have you thought of everything?

Before you start writing your will, there are a few things you should be aware of. Our checklist will give you an overview in advance.

- Identify a trusted person: Think about who is a reliable person in your environment who could implement your wishes in an emergency or take care of important matters.

- Determine heirs and/or legatees: Think about who should inherit your assets or certain things.

- Create an overview of your assets: Get an overview of all your belongings. This includes: Cash, bank accounts, real estate, financial investments, vehicles, precious metals, coins and even pets.

- List contracts: Collect all important contracts, such as life insurance policies, rental agreements or subscriptions. This makes it clear what obligations exist or who the beneficiary is.

- Check liabilities: List what debts or outstanding payments there are. This helps to ensure that your heirs are not surprised by unexpected burdens later on.

Create a list of next of kin: Have the contact details and relationship of your closest relatives ready. - Make a note of your wishes: Think about who should be notified in the event of your death and what personal wishes you have for the time after your death - for example, regarding your funeral or grave care.

- Organize your documents: Put all important documents in one place and inform a trusted person about them. Important documents include your will, your birth certificate, your account overview, important addresses and your funeral wishes.

Tip: Prescribe a will and then copy it

Your handwritten will is only legally secure and valid if you write it by hand. However, this does not mean that you cannot write it on the computer or via an online service and then copy it out.

This step can help you to finally check your will for completeness. You can also edit, add to or discard it more easily.

Not to be neglected: Drawing up a will means dealing with your own finiteness. This can be scary and overwhelming. So "practising" and trying things out can take the pressure off you to get everything right straight away and settle everything definitively.

Your will can be revoked at any time

A will is not carved out of stone, but literally written on paper. If you change your mind or want to change or destroy your will, you can simply tear it up. This makes it legally ineffective.

Of course, you can also simply rewrite your will or revoke your old will in a new one with one sentence.

3. write your will in 7 steps

A sheet of paper and a pen: that's all you need to draw up a will. You can easily write your will yourself in these 7 steps. At the same time, you can use our instructions to ensure that your will is complete and therefore legally valid.

Instructions in 7 steps

By hand from start to finish

Write the text yourself and in full by hand. A typed document, even if signed, is invalid.

If the handwriting is illegible, you can attach a typewritten copy to the handwritten will as a reading aid.

Only valid with signature

Sign your will with your first name and surname. This is essential to identify you as the author of the will.

Place and date provide clarity

Include the place and date of creation in your will. This is because a more recent will replaces an older one. Place and date prevent ambiguity.

Not necessary, but useful: Heading

Although a heading is not formally required, it makes it easier to identify the document and underlines your seriousness.

Possible: revoke an earlier will

If you have already written a will that is no longer valid, you must expressly revoke it in your new will. You can simply use the following wording at the beginning of your new text: "I hereby revoke all my previous wills in their entirety."

Formulate concretely and clearly

Your will must clearly state who is the heir, who receives a legacy and/or which conditions apply to whom. Therefore, formulate clearly, completely and in as much detail as possible who receives what.

You can use the structure of this formulation as a guide:"The Wilderness International Foundation, Grundstraße 1 in 01326 Dresden, Germany, is to receive a legacy of X € from my inheritance."

Numbering and stapling together

If your will has several pages, sign each page, number them and staple them together. This ensures completeness and can prevent individual pages from "disappearing".

Safe storage

You can keep your will anywhere. It should be found safely and quickly. We recommend that you inform at least one person you trust that you have written a will and where it can be found.

To be on the safe side, you can have it stored at the relevant local court for a fee. Your will will then be safely and securely recorded in the Central Register of Wills.

Instructions: Writing a will

You can simply download our information material and write your own will at your leisure.